PRE-APPROVAL REPORT

We advise Pre-Approval as a starting point of setting up an account. Instead of applying for one account and hope for the best, we suggest you to order Pre-Approval in several institutions.

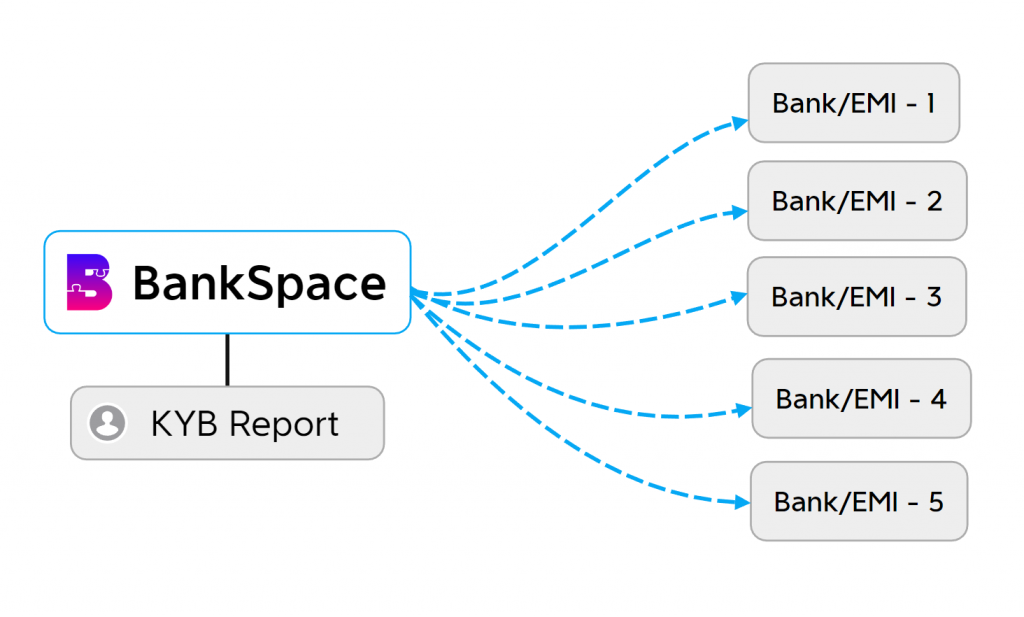

We will create your profile (KYB Report), and share it with 5 potentially favorable banks/EMIs selected specifically to match your requirements and your risk profile. We carry on communication with the institution and receive either a preliminary approval or a rejection.

Thus you may review your options and choose the next step.

- Cost effective

- Cost effective

- Cost effective

How it works?

Step

Chek-in

- Tell us what you are looking for

- Tell us about your business

Step

Assesment

- Profile analysis

- Selection of Fls which meet your needs

Step

Processing

- Your KYB profile setting up

- Necessary KYC & KYB checks

- Negotiations with the selected Fls

Step

Report including:

- Rejection (if any)

with comments

- Pre-approval

with direct contacts of your manager from FI and proposed fees plan

Here is a basic list of documents, which you should prepare to open your corporate account:

- Articles of Association|Memorandum | Bylaws

- Register Extract | Certificate of Incumbency

- Certificate of Incorporation

- Company licenses/certifications (if applicable)

- Company licenses/certifications (if applicable)

- Power of Attorney (if applicable)

- Business profile for the bank describing your planned transactions, their volume etc. (we provide you a questionnaire)

For each company officer (director, shareholder, UBO, attorney etc.):

- Passport

- Address proof (or utility bill, or internal ID card)

In case of corporate shareholder(s) the set of documents above is required for each legal entity in the structure.

Fees

(NON-Refundable)

PRE-APPROVAL REPORT

Lite

Basic

Professional

Business

€ 1500

€ 3000

€ 5000

License holders

€ 1500

€ 3000

€ 5000

This is highly recommended to consider ordering Pre-Approval Report before applying to open account. From our experience this constitutes 80% of successfully opening a bank account.

Once the payment for services is settled, we start working on your Report: collecting documents, information, making independent requests to Government Corporate Registries, and check on AML Sanctions/PEP/Adverse media Watchlists. The payment is not refundable.

FAQs:

- Business bank account

- Business EMI account

- Payments acquiring solutions

- PSP/BaaS/White Label solutions

Please b to get your unique proposal

- Business bank account

- Business EMI account

- Payments acquiring solutions

- PSP/BaaS/White Label solutions

Please b to get your unique proposal

AML compliance and risk appetites are important factors to consider. Financial institutions are subject to strict regulations related to money laundering and terrorist financing, and they may have different risk appetites depending on their size and business model. By doing pre-approval in several financial institutions, businesses can identify which institutions are most likely to meet their needs. This can help businesses avoid wasting resources on applications that are unlikely to be approved due to compliance or risk-related issues.

Moreover, it is important to note that each financial institution has unique internal policies and due diligence procedures that they follow when evaluating and approving new customers. In summary, taking the time to do pre-approval procedures in several financial institutions can help businesses gain a better understanding of the AML compliance measures and risk appetites of different institutions, avoid unnecessary rejections, and increase the chances of approval by providing additional valuable information